The Claims Quagmire

The Claims Quagmire

If you’re an insurance restoration contractor, you already know how easy it is to get overwhelmed with the complexity of running a business AND dealing with the details of insurance claims. Add in the other challenges the roofers face like crew shortages, employee training and high claim volume from storms, and it’s easy to why so many contractor trainings/events this year have focused on automating and streamlining tasks.

One of the biggest time wasters that a contractor will face is the insurance claim process. Most contractors we talk to come to us because they are operating in two capacities: either the owner does all of the claim/supplement work, or they allow their sales team to work their own claims.

While some companies have mastered the balance of those roles, most people don’t have enough time to sell new jobs, manage the ones they have, work with customers and handle issues, build jobs and/or run the business.

The first step to increasing productivity is to get organized and decide what type of insurance claim management structure is right for your business – in-house or outsourced.

If you decide to go in-house, you’ll need a thorough training program to be effective and remain in compliance. If you outsource, you may need to ensure you have the technology and tools required like a CRM, photo documentation process, etc. for all parties to be successful.

Next, determine how the people involved in a claim will fit together – who does what and when? Common roles include:

Focus on creating processes that lead to better organization and productivity. Here are a few we would recommend:

Without the proper organization and structure, you can’t run a productive and efficient (even profitable!) business. Does your company have an internal or outsourced insurance claim supplement team? We’d love to hear what’s working and what’s not working for you. Join the conversation on Facebook or LinkedIn or send us a message.

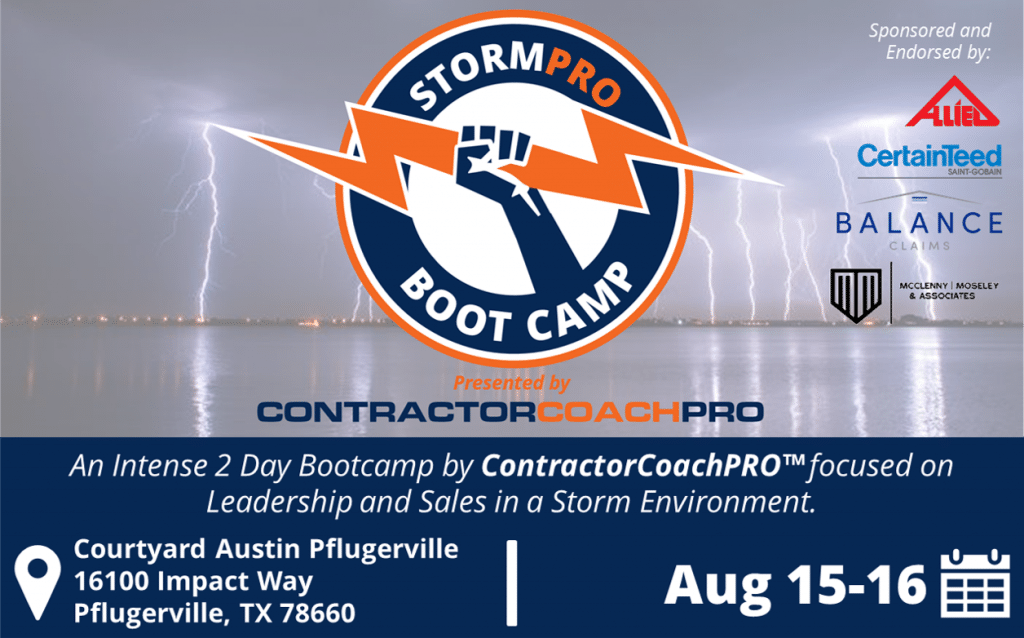

We’re thrilled to be partnering for another incredible opportunity for contractors and roofers to learn from the pros at ContractorCoachPRO! The team...

Our number one goal at Balance Claims is to help contractors find solutions that work for them when it comes to estimating and supplementing...